Here's the Max Social Security Benefit for Retirees in 2024, and the Salary You Need to Get It | The Motley Fool

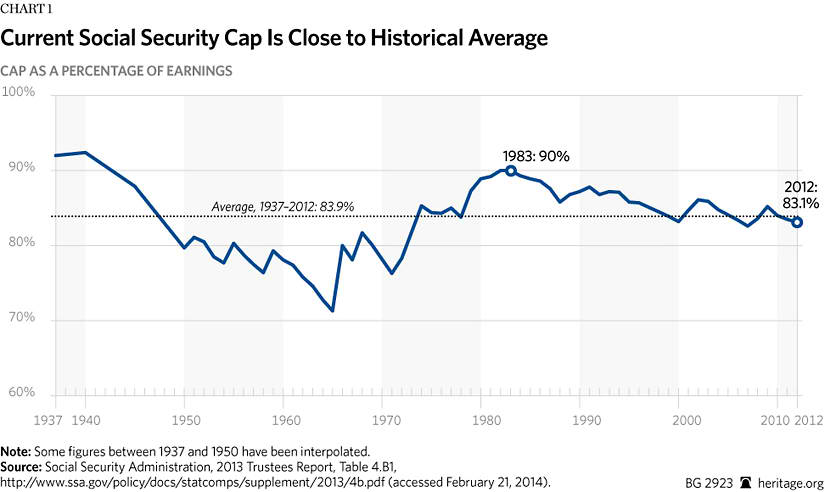

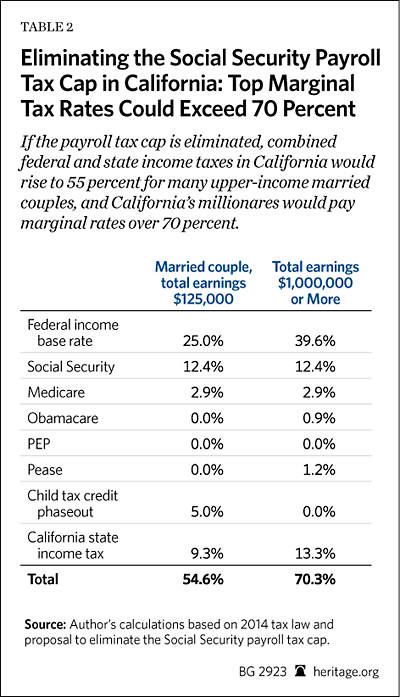

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Who Would Pay More if the Social Security Payroll Tax Cap Were Raised or Scrapped? - Center for Economic and Policy Research

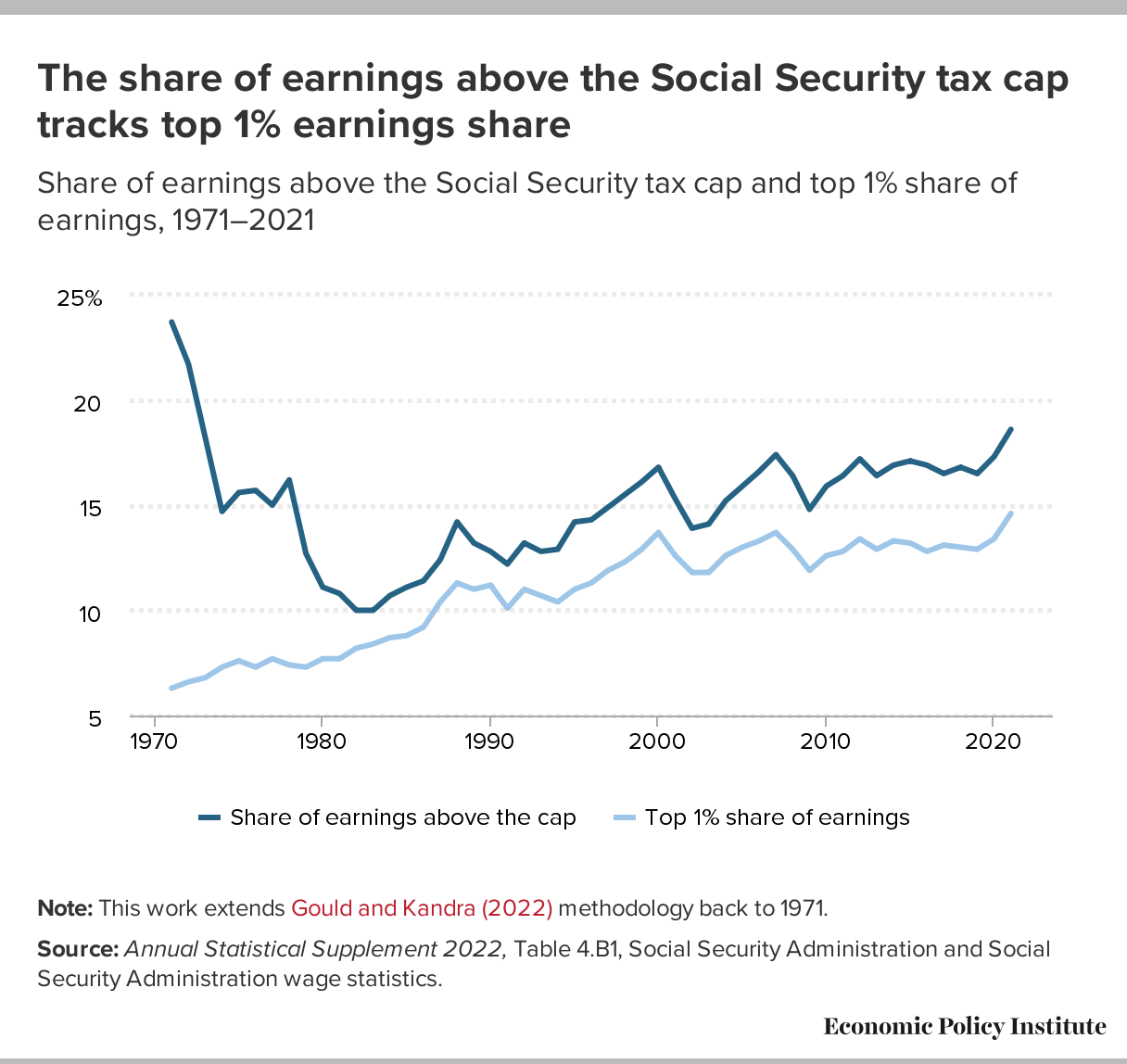

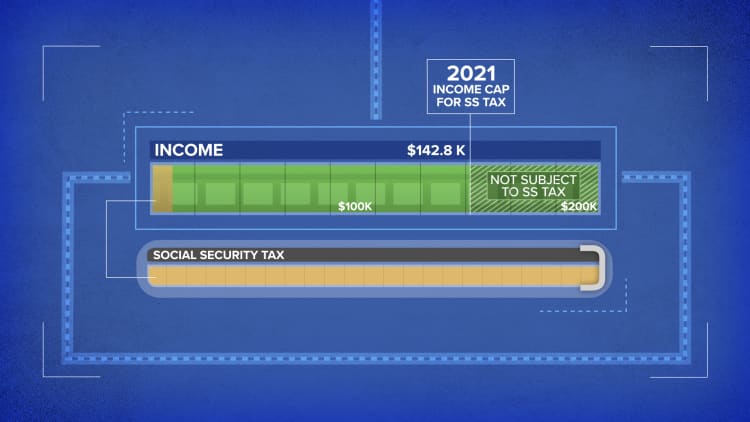

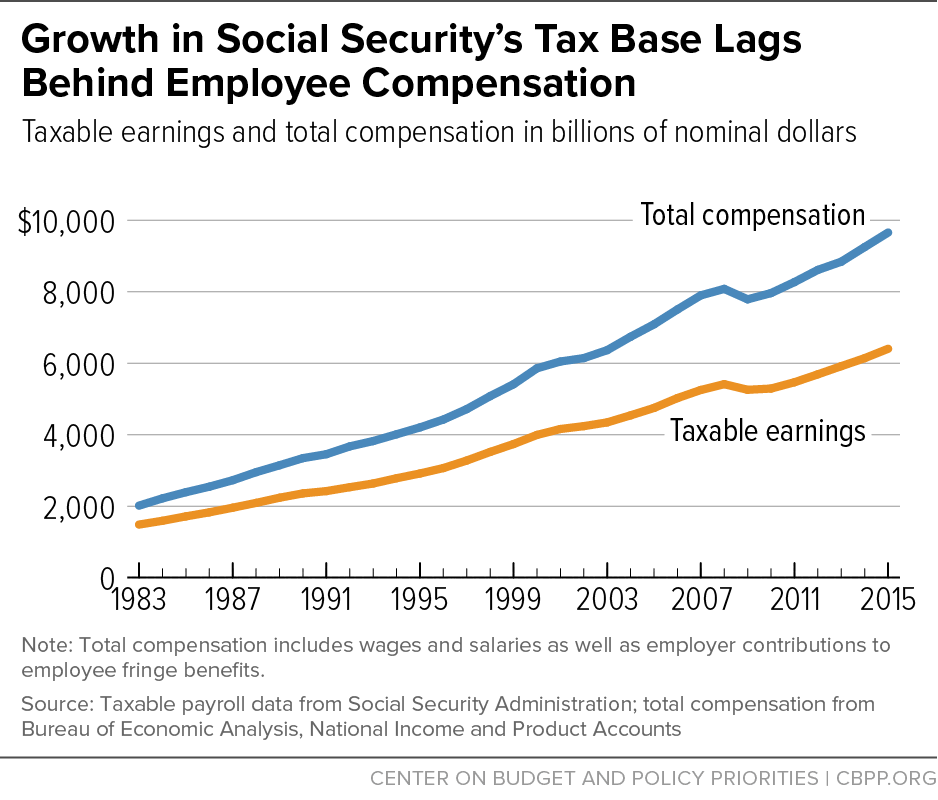

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

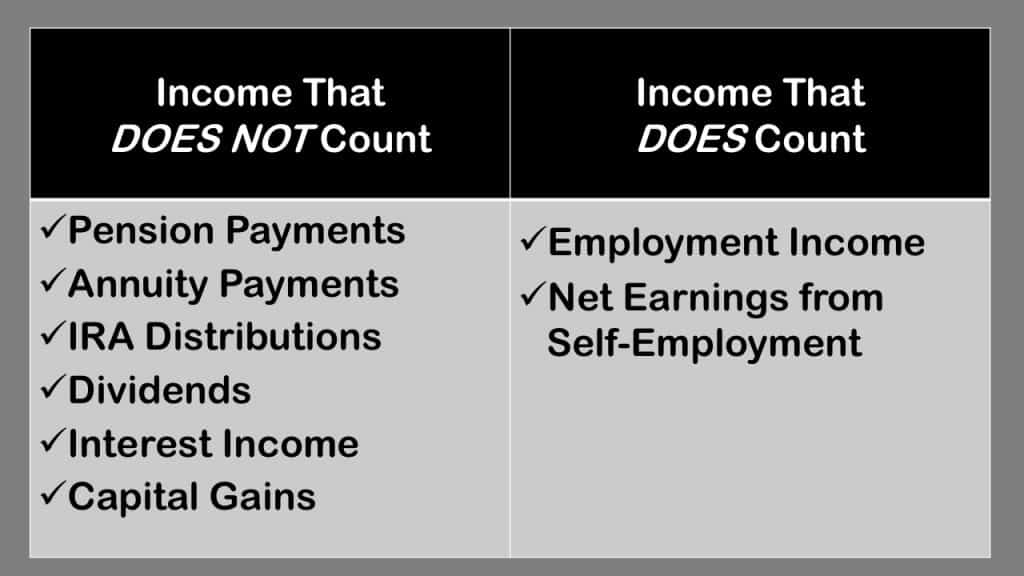

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

:max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1168040761-5ae0caa8adf64faa960c2e4964ca1333.jpg)